Travel Guidelines

Unallowable/Personal Expenses

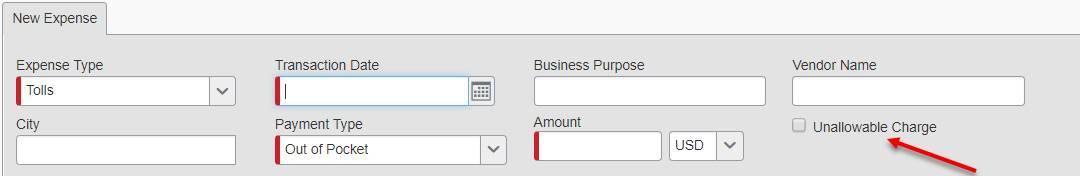

Personal charges on travel cards are generally not allowed and should not be intentionally put on travel cards. Personal charges should be paid out of pocket. An example for when this could occur is when a traveler unknowingly exceeds the GSA rate for a particular location while their department limits them to that rate, or they do not have substantiation for all meals on that date. In either cases they’d need to mark any GSA overage as “Unallowable.” This checkbox was intended to be rarely used, and only when it was truly unintentional or unavoidable.

Any expense or portion of the expense marked unallowable will be due immediately upon receipt of invoice. Accounts receivable will be set up to track the amount due and if the amount is not paid timely the employees card will be suspended and vendor record put on hold to stop any reimbursements from being paid to the employee until the unallowable expense is reimbursed.

In addition if the invoice for unallowed expense is not paid within 90 days from the trip end date it will be recorded as income and taxes withheld. The receivable would still remain outstanding and required to be paid back.