Purchase Guidelines

Moving or Relocation Costs

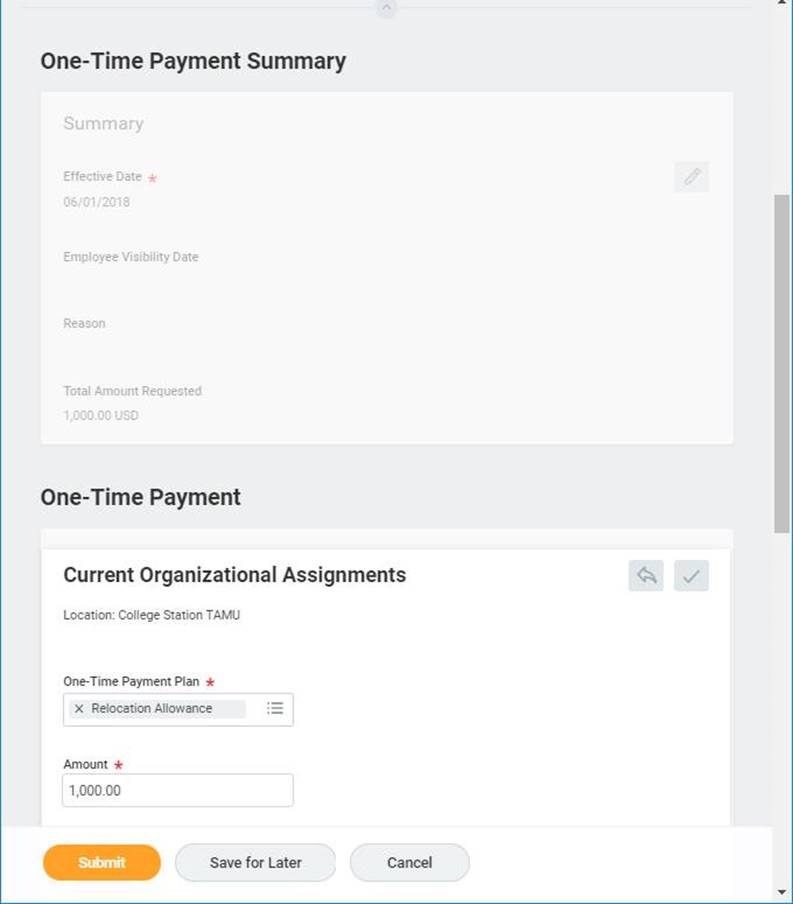

All employee moving/relocation costs are to be paid as an allowance through payroll. Payments for relocation allowances are processed as a one-time payment through Workday and paid to the employee on their first regular payroll cycle after their official start date (select the One-Time Payment Plan "Relocation Allowance".)

The allowance must be paid from local or sponsored research funds, however no state funds may be used. Allowances are considered taxable income to the employee. Allowances will be reduced by the applicable federal income tax and FICA deductions.